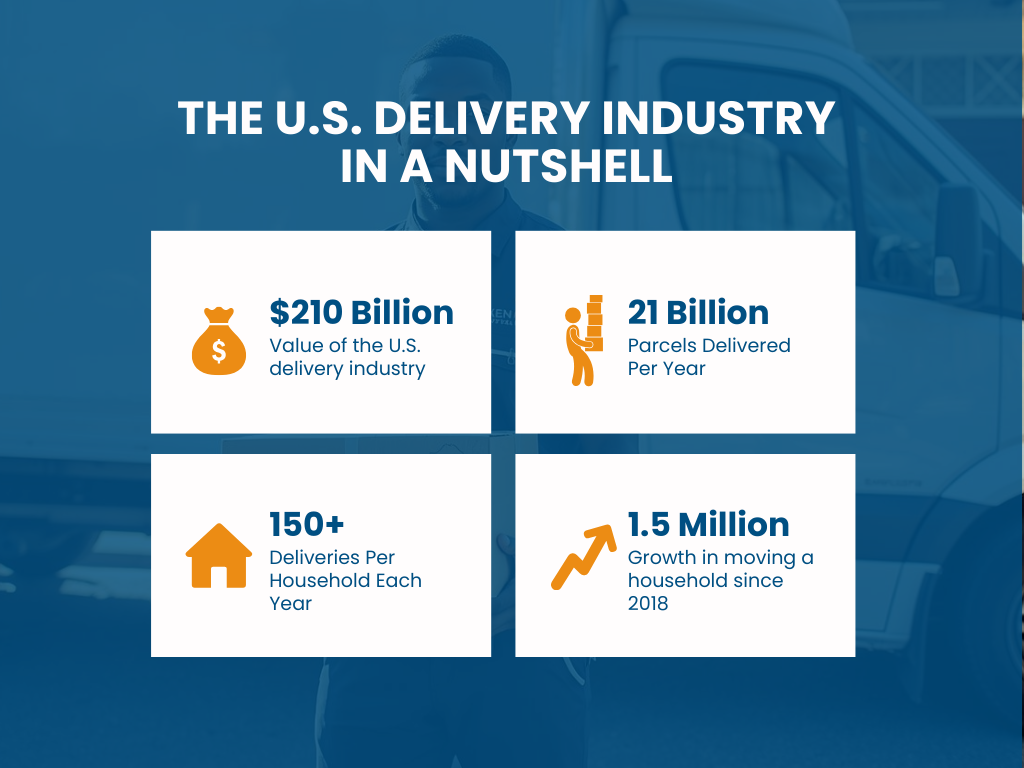

The United States is the largest delivery and courier market in the world. Each year, the country processes over 21 billion parcel deliveries, employs more than 1.5 million delivery and logistics workers, and generates well over $210 billion in delivery-related revenue.

These figures include small parcel shipping, last-mile delivery, residential and commercial shipments, and specialist transport for larger goods. Together, they reflect how deeply delivery services are embedded in everyday American life.

Below are the key statistics that define the size, scale, and growth of delivery services in the United States.

How Big Is the Delivery Industry in the United States?

The U.S. courier, express, and parcel industry is estimated to be worth more than $210 billion annually, depending on how international shipments and specialist transport services are classified.

This total includes:

- Business-to-consumer deliveries driven by e-commerce

- Business-to-business shipments between companies

- Residential and last-mile delivery services

- Cross-border and international parcel flows

- Delivery of bulky and high-value items such as furniture, appliances, and vehicles

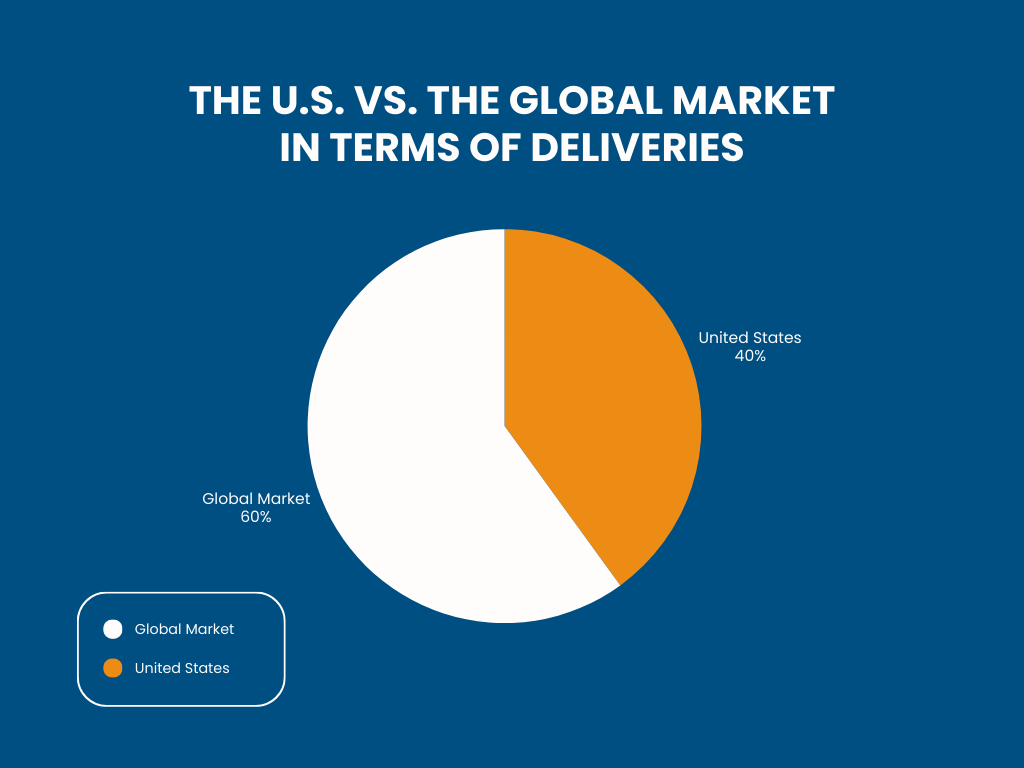

The United States alone accounts for roughly 40 percent of global parcel revenue, making it the single most influential delivery market worldwide.

How Many Parcels Are Delivered in the United States Each Year?

The United States processes approximately 21 billion parcel deliveries annually. The United States processes approximately 21 billion parcel deliveries per year.

To illustrate the scale of that volume:

- About 1.7 billion parcels per month

- Around 400 million parcels per week

- Roughly 58 million parcels per day

- More than 2.4 million parcels per hour

- Approximately 40,000 parcels per minute

- Over 650 parcels per second

Parcel volumes have more than doubled since the early 2010s, largely due to sustained growth in online retail, subscription services, and faster delivery options becoming standard for many purchases.

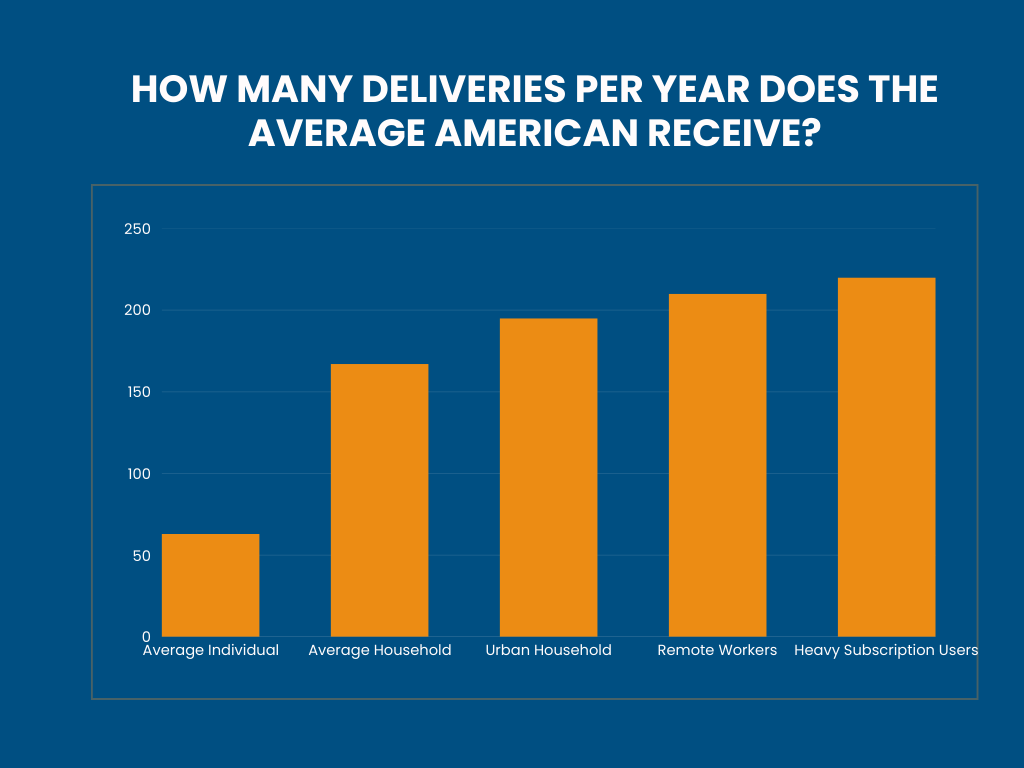

How Many Deliveries Does the Average American Receive Each Year?

On an individual basis, the average American receives between 60 and 65 deliveries per year. However, this figure varies widely depending on lifestyle and location.

Key patterns include:

- Urban and suburban residents receive more deliveries than rural households

- Younger adults and families receive more parcels than older individuals

- Subscription users and remote workers often receive more than 100 deliveries annually

Household-level data provides a clearer picture. The average U.S. household now receives well over 150 deliveries per year, reflecting shared consumption across multiple people.

How Fast Are U.S. Deliveries Growing?

Delivery volumes in the United States have grown steadily for more than a decade, with a sharp acceleration during the COVID-19 pandemic.

Over a ten-year period:

- Annual parcel volumes increased by more than 150 percent

- E-commerce-driven deliveries grew faster than overall retail spending

- Last-mile delivery became the fastest-growing segment of logistics

Although growth rates have moderated since the pandemic peak, delivery volumes continue to rise at mid to high single-digit annual rates, supported by lasting changes in consumer behavior rather than temporary trends.mporary trends.

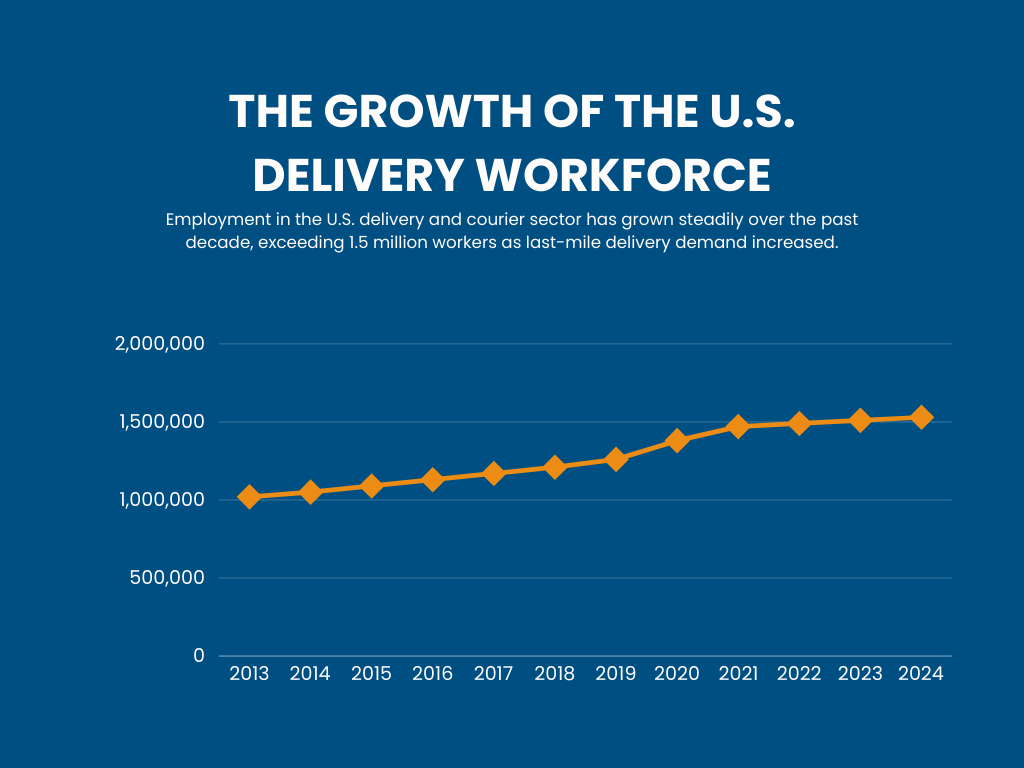

How Many People Work in the U.S. Delivery and Courier Industry?

TheThe U.S. delivery and courier sector employs more than 1.5 million people nationwide.

This workforce includes:

- Drivers and couriers

- Warehouse and fulfillment staff

- Sorting and distribution center workers

- Dispatchers and logistics coordinators

- Customer service and operational roles

Employment growth has been strongest in last-mile and residential delivery roles, reflecting the increasing importance of home delivery.

How Fast Do Americans Want Their Deliveries?

Consumer expectations for delivery speed are high and continue to rise. To put things into perspective:

- More than 60 percent of consumers expect next-day delivery as standard

- Over half consider same-day delivery important for certain purchases

- Nearly two-thirds are willing to pay extra for faster shipping

At the same time, reliability matters as much as speed. Accurate delivery windows, tracking updates, and predictable arrival times strongly influence satisfaction.

A Smarter Way to Ship in the United States

As delivery volumes continue to grow, choosing the right transport option becomes increasingly important, especially for large or non-standard items.

Shiply connects customers with trusted transport providers already traveling their route, making it easier to move furniture, vehicles, motorcycles, and other bulky goods efficiently and affordably. By comparing quotes in one place, customers can find the right balance between cost, speed, and reliability.

Get free delivery quotes today and see how Shiply makes shipping smarter, more flexible, and more affordable.

Sources: Investor Relationships, Yahoo Finance, Parcel and Postal Technology, Capital One Shopping, Pitney Bowes, Statista, McKinsey & Company, US Census Bureau, US Bureau of Labor Statistics

Kate Margallo

Kate Margallo